It doesn’t matter how clean the repair job looks or how small the damage – an accident knocks value off your car, full stop. Once it’s been in a crash, anyone thinking of buying it down the line can look up its history and see it.

But how much value does a car lose after a prang? Is a scuffed bumper treated the same as major frame damage? And if you’re thinking about selling, trading in, or dealing with insurance, what do you need to know?

In this article, we’ll talk about the numbers, the context, and what past accidents do to your car’s worth today. Keep reading!

Your Car Will Lose Value…

It’s a tough pill to swallow, but your car’s value after an accident won’t be the same. Why? Because buyers are cautious. Besides the car, they’re buying its history too. And if that history includes a collision, many will hesitate. Some will walk away entirely, but everybody will expect a discount.

Dealers will absolutely factor it in. When you go to trade it in, dealerships run your VIN through many databases and see the accident, the repairs, and everything in between. Following that, they’ll lower the offer accordingly—even if everything looks fine.

If you’re curious what shows up when a dealer checks your VIN, you can run your own car history report through VinSpy—it’s the same kind of data they’ll be looking at.

It’s not always about what was repaired. It’s the what-ifs that worry people:

- What if the frame isn’t perfect?

- What if the airbags were replaced?

- What if it starts rattling in a few months?

Even if none of that is true, the doubt alone reduces resale value. That’s what the industry calls inherent diminished value—the idea that any repaired vehicle is worth less purely because it’s been in an accident.

And that’s not something you can just scrub off with a receipt. Once it’s on the car’s history, it’s there for good.

So yes, the value will drop, but the question is: how much?

How Much Value Are We Talking About?

The value drop of a car after an accident is called diminished value, and it’s the difference between the car’s pre-accident condition value and what it’s worth now, post-repairs.

It’s not a fixed number. It depends on a mix of factors: how bad the damage was, how well it was repaired, how new or old your car is, and even the kind of car you drive.

As a rough guide, minor damage like scratches, scuffs, or a dented panel might lower your car’s value by a few hundred dollars, if at all. But once you get into structural damage (like bent frames, airbag deployment, or anything that requires extensive bodywork), you’re likely looking at a much bigger drop.

On average, a serious car accident can lower resale value by about 20–30%.

To put that in perspective, a $45,000 SUV with collision repairs could lose up to $13,000 in resale value. A $12,000 commuter car with cosmetic damage might only drop $500. The higher the value (and the newer the vehicle), the harder that drop usually hits.

Context plays a big role. A near-new car with a perfect history is going to suffer more from a major claim than a decade-old car that’s already had a few bumps along the way. And while some buyers don’t mind a fixed bumper, others won’t go near anything with a claim on the record.

Repair Quality Impacts Your Car’s Value

There’s a big difference between a car that’s been fixed at a licensed body shop using OEM (original equipment manufacturer) parts and one that was patched up with cheap aftermarket pieces in someone’s garage. The first tells buyers the job was done right. The second calls for caution.

This is where repair-related value loss starts having its effect. It’s not just that the car had an accident, it’s how well (or badly) it was fixed. If the paint doesn’t match, a door doesn’t sit right, or something just feels off when you drive it, that’s going to cost you.

Even when the car looks fine, most buyers want proof. That means invoices, service records, and a clear repair history from a reputable shop. It shows that corners weren’t cut, and that can make a big difference when it’s time to sell.

A clean repair with the right parts and paperwork won’t erase the accident, but it can soften the impact. Sloppy work, on the other hand, gives buyers one more reason to walk away—or offer less.

Want to know what’s on your vehicle’s record before selling? A quick VIN check with VinSpy can reveal any accident history or structural issues you might need to address.

Insurance Won’t Cover Everything

Here’s something a lot of people don’t realise: your insurance company will pay to fix your car, but not for what it’s worth after.

You might think, “If it’s repaired, why would it still lose value?” And if it does, shouldn’t insurance cover it? Fair question. But most policies don’t work that way. What they cover is property damage—basically, putting your car back into working order. That’s all. Even when fully repaired, your car’s market value still drops just for having an accident on record, and you’re often left to absorb it.

Let’s say your car was worth $25,000 before the crash. After repairs, it’s mechanically sound, but now buyers only offer $19,000 because of the accident history. That $6,000 difference is your loss on value.

In some cases, if the crash wasn’t your fault, you can file a diminished value claim with the other driver’s insurance. But it’s not a given. Not all regions allow it, and most insurers don’t hand over that kind of payout easily.

So if you’re expecting insurance to make you “whole” after an accident, understand that “repairs” and “value” are two very different things—and only one is typically covered.

What Happens When You’re Not at Fault?

Not being at fault should make things easier. And technically, it gives you more options, but that doesn’t mean it’ll be easy.

Yes, you might be able to file a diminished value claim against the at-fault driver’s insurance. But that’s just the start. You’ll still have to prove your case, negotiate the payout, and possibly deal with an insurer that’s motivated to offer the bare minimum—or nothing at all.

What does change is your legal footing. You may have more leverage, especially if your vehicle was newer, had no prior damage, or is a higher-value model. But don’t assume that means a payout is guaranteed.

Also, being “not at fault” doesn’t change the reality of resale value. Buyers won’t care whose fault it was. All they’ll see is that the car’s been in a crash, and they’ll price it accordingly.

Structural vs Cosmetic: The Value Gap

A scratched door or cracked headlight might knock a little off your car’s value, but structural damage is a different story.

When a vehicle’s frame or chassis has been bent, twisted, or compromised in any way, it changes how people see the car. Even if it’s been professionally repaired, the assumption is that the car will never be quite the same.

Buyers see it as a risk. So do most insurance companies. In fact, structural damage is often enough for a write-off, not because it can’t be fixed, but because it’s not worth fixing. And if it has been repaired, that car gets a tag like “Category S” or a “Statutory Write-Off” marker, which scares off most buyers before they even read the listing.

Cosmetic issues like paint scuffs, small dents, and chipped trim are far less damaging to value. Most buyers expect a few imperfections on a used car, especially as it ages.

If you’re figuring out what your car’s worth now, it helps to know which kind of damage you’re dealing with—and what it signals to the next person looking to buy.

Can You Sell It Anyway?

Yes, you can still sell a car that’s been in an accident. But you’ll need to be realistic.

Dealers will almost always adjust their offer if the accident history shows up in a database. Private buyers will either negotiate hard or walk away if they feel you’re hiding something. That’s why transparency matters. Be upfront about the damage, have your repair records ready, and price the car accordingly.

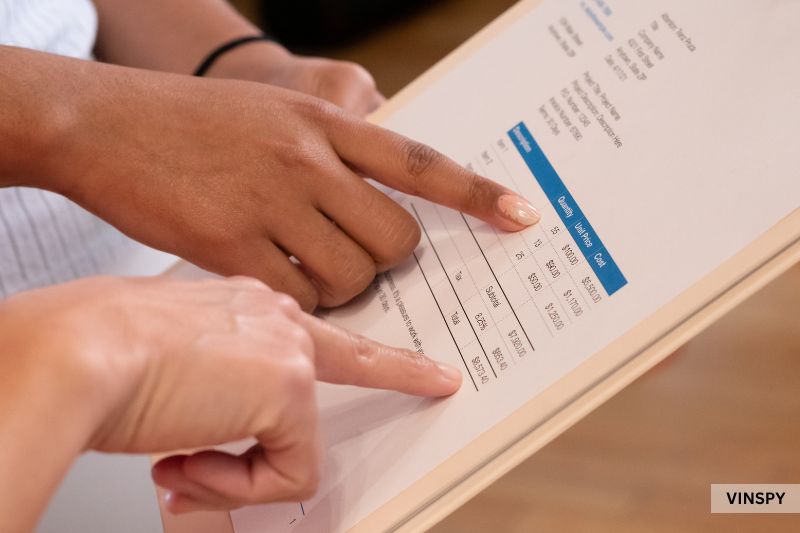

The more information you provide, the more confidence you give a buyer. Tools like VinSpy can help you pull up the vehicle’s history, confirm past repairs, and even identify what a potential buyer might see when they run a check themselves.

You might not get top dollar, but if you’re honest, prepared, and willing to meet the market where it is, you’ll still get a fair deal.

And while you can’t erase a crash from your car’s record, you can show it was repaired properly. Share photos of the damage before and after, list any OEM parts used, and keep receipts from a licensed shop. A service warranty doesn’t hurt either.

Buyers don’t expect perfection, but they do expect transparency. If you can prove the repair was done right, you’ll have a much better shot at closing the deal on your terms.

If You Plan to Claim, You’ll Need Proof

Filing a diminished value claim sounds straightforward, but it takes a lot more than just saying your car’s worth less now.

First, these claims usually only apply if you weren’t at fault. Second, the burden’s on you to prove two things: what your car was worth before the crash, and what it’s worth now. That means you’ll need documentation—and lots of it:

- Pre-accident valuations

- Detailed repair invoices

- Photos before the repairs

- A current appraisal from a qualified expert

The more complete your file, the stronger your case.

A VIN check from VinSpy can also serve as part of your supporting evidence, especially in combination with detailed records and pre-accident valuations.

Some drivers also get a written report from an independent appraiser, which compares your car’s market value before and after the crash. If the insurer refuses or lowballs the offer, you might even need legal help.

So no, this isn’t free money, but with evidence on your side, fair compensation is still on the table.

Your Car’s Value Isn’t Gone!

Just because your car’s been in an accident doesn’t mean it’s worthless, far from it. But it does change how people look at it (and what they’re willing to pay).

Whether you’re selling it, trading it in, or chasing a diminished value claim, what matters most is understanding where your car now stands in the market. That means knowing the facts, having the right documentation, and being realistic about what buyers (and insurers) are willing to pay.

Yes, accident history stays, but so can fair value, if you handle it right. Get informed, stay transparent, and don’t assume all is lost just because your car has a story.